A Variable Annuity Has Which of the Following Characteristics

However some variable annuities also offer a fixed-rate account which is guaranteed by the issuing insurance company. Bianca has FINRA Series 7 63 SIE licenses and has licensing program at her firm for 5 years.

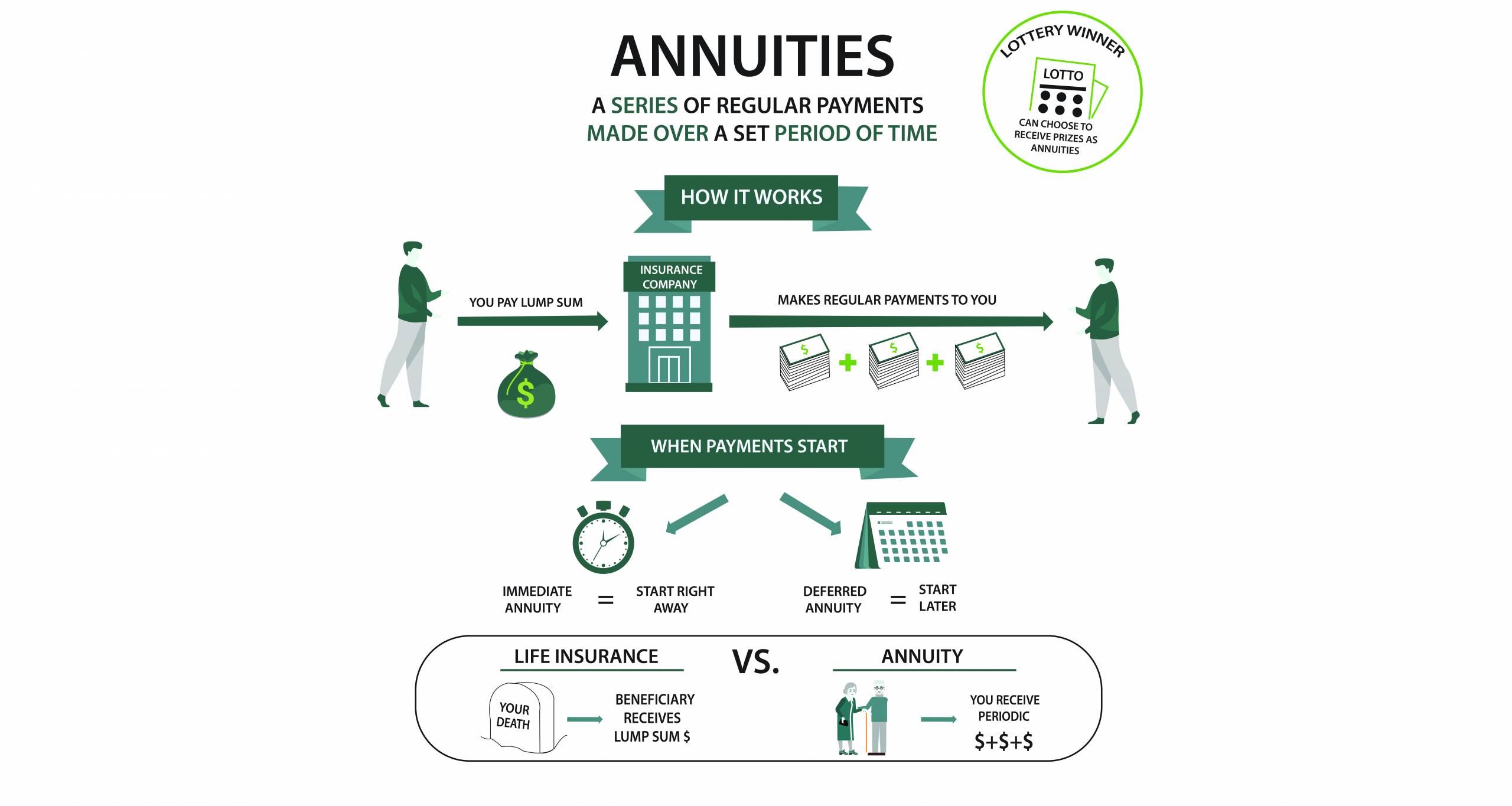

Annuity Vs Life Insurance Similar Contracts Different Goals

Ad Learn More about How Annuities Work from Fidelity.

. The growth of these accounts is also tax-deferred. In general variable annuities have two phases. At the end of the year your account has a value of 10750.

There are no surrender fees. Under fixed annuities the buyer has two payment options. You purchase a variable annuity with an initial purchase payment of 10000.

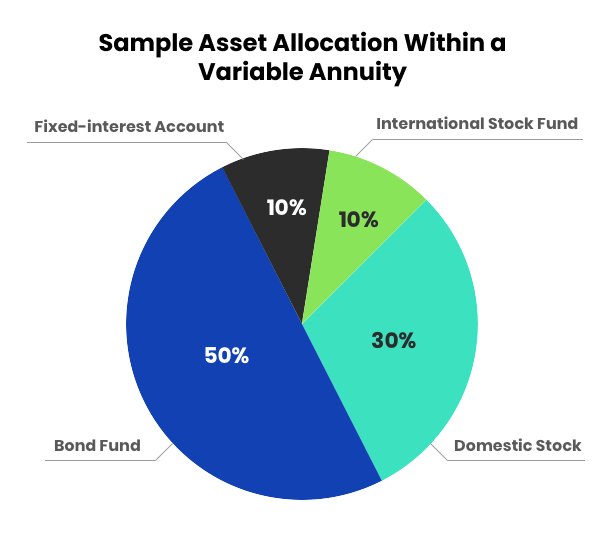

All of the following are characteristics of Variable Annuity contracts EXCEPT. You allocate 50 of that purchase payment 5000 to a. The rate is usually adjusted once a year by the insurance company to reflect current interest rates.

A used for the investment of monies paid by variable annuity contract holders B separate from the insurance companys general investments C operated in a manner similar to an investment company D as much a security as it is an insurance product. During this lesson we will review the characteristics. With variable annuities policyholders can choose from a number of investment opportunities.

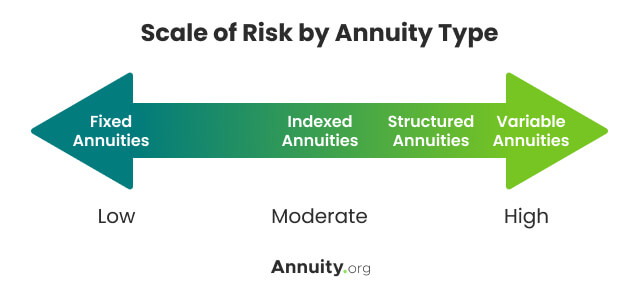

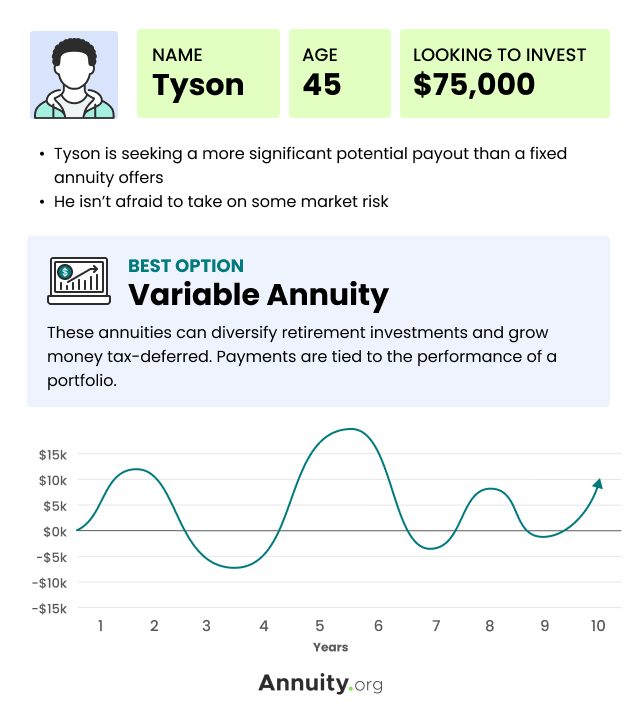

A variable annuity is different from a fixed annuity in that it does not guarantee an interest yield from investments. Suppose the board were going to invest in an ordinary annuity requiring a payment of 10000 over the. Variable annuities offer the possibility of higher returns and greater income than fixed annuities but theres also a risk that the account will fall in.

A variable annuity has two phases. What is a variable annuity and how does it work. An important basic characteristic of common stocks that makes them a suitable type of investment for the separate account of variable annuities is.

1 the accumulation phase when the premiums you pay are allocated among investment portfolios or subaccounts and your earnings on these investments accumulate. Over the following year the stock fund has a 10 return and the bond fund has a 5 return. As a result the money that would have been taxed is still working for you increasing your overall yield.

A variable annuity is a tax-deferred retirement vehicle that allows you to choose from a selection of investments and then pays you a level of income in retirement that is determined by the performance of the investments you choose. A the safety of the principal invested B the yield is always higher than bond yields. Variable annuities have two components.

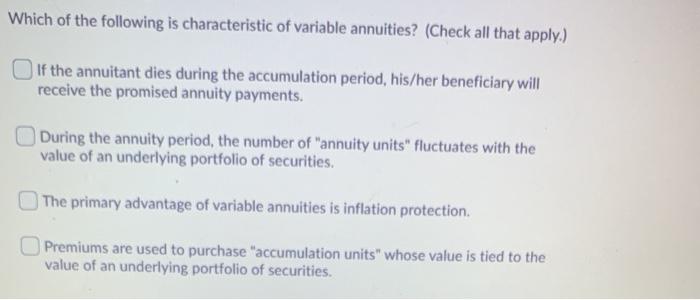

An accumulation phase and a payout annuitization phase. All of the following statements about fixed annuities are true EXCEPT. During the annuity period the number of annuity units fluctuates with the value of an underlying portfolio of securities.

Your contributions age and interest rate are all taken into account when you purchase a fixed instant annuity. Say youre 60 years old and your actual investments are worth 350000 but your benefit base has grown to 500000 over a number of years. Variable annuities have separate accounts that hold stocks and bonds like a mutual fund.

The amount of the purchase payments that go into the account may be less than you paid because fees were taken out of the purchase payments. A principal of a brokerage firm must review all of the following EXCEPT Your client Mr Jones purchased a YLD corporate bond with a 65 percent coupon. And 2 the distribution phase when the insurance company guarantees a minimum payment to you based on the principle and investment returns.

All of the above. The organization has the benefit of different revenue streams including patient revenue and returns on investments. The possibility of higher returns and greater income than fixed annuities but theres also a risk that the account will fall in value.

Fixed annuities earn a rate of interest determined by the insurance company. Underlying equity investments T age 70 withdraws cash from a profit-sharing plan and purchases a Straight Life Annuity. The return is the income the policyholder makes through their investment selection.

With a variable immediate annuity the payments you receive will depend on the investments you make. The principal and the return. The principal is the amount the policyholder pays into the annuity.

A Variable Annuity has which of the following characteristics. You will never see a change in the amount of money you receive from those installments. The primary advantage of variable annuities is inflation protection Premiums are used to purchase accumulation units whose value is tied to.

Bond fund and 50 5000 to a stock fund. If you withdraw 4 of the benefit base every year which. During the accumulation phase you make purchase payments.

As with all annuities variable annuities provide tax-deferred growth. If the annuitant dies during the accumulation period hisher beneficiary will receive the promised annuity payments. Immediate annuities guarantee that the income payments start immediately after the inception of the annuity usually within a monthor one year from the purchase date depending on whether the income is paid monthly or annually.

The variable annuitys value is based on the performance of underlying investment portfolios. Compare that to a fixed annuity which provides a guaranteed payout. This means that any income or gains accumulated are not taxed until its withdrawn.

A variable annuitys separate account is.

Variable Annuity Features Common Attributes Of Variable Annuities

Variable Annuity Features Common Attributes Of Variable Annuities

2 2 The Economic Trend 2007 A 2011 And Realization Projection 2012

Dividend Stock Quizzes Bba Financial Management Quiz 5 Questions And Answers Practice Finance Quizzes Based Financial Management Finance Dividend Stocks

Phillip Roy Financial Consultants Va Financial Phillip Places To Visit

Variable Annuity Features Common Attributes Of Variable Annuities

Effect Of 1 Of Annuity Income And Earned Income On Beginning And End Download Scientific Diagram

Variable Annuity What Are Variable Annuities How Do They Work

Learn Quiz On Cost Benefit Analysis Applied Math Quiz 2 To Practice Free Mathematics Mcqs Questions And Answers To Learn Cost Benef Analysis Online Quiz Quiz

Solved Which Of The Following Is Characteristic Of Variable Chegg Com

What Is An Annuity Rates Types Pros Cons

Types Of Annuities Understanding The Different Categories

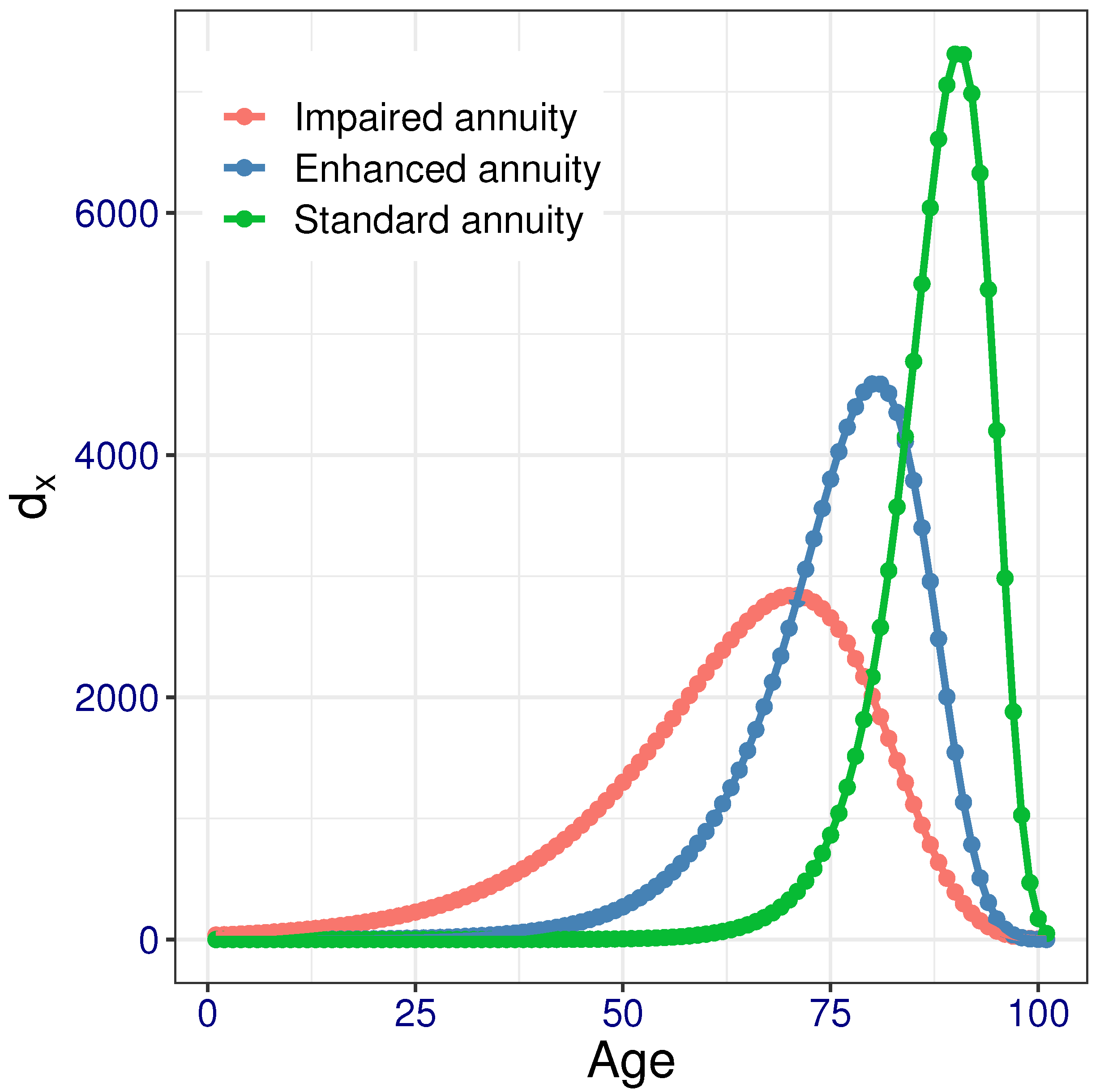

Risks Free Full Text Special Rate Life Annuities Analysis Of Portfolio Risk Profiles Html

Variable Annuity What Are Variable Annuities How Do They Work

Applications Of Fuzzy Regression In Actuarial Analysis De Andres Sanchez 2003 Journal Of Risk And Insurance Wiley Online Library

Solved Question 28 Annuities Have Many Features And Characteristics Which Of The Following Statements Is Correct The Initial Rate On A Fixed Annu Course Hero

/annuity_calculate-5bfc2f6746e0fb00260bd9e9.jpg)

Comments

Post a Comment